As Ursula von der Leyen has rebuked the option of EU backing for nuclear power under the bloc’s Net-Zero Industry Act, Samuele Furfari, engineer, a Professor of Political Science and Applied Science at the University of Brussels and Ernest Mund, honorary research director of the FNRS, Emeritus extraordinary professor UCL, open the debate on energy transition and the reasonable schedule it should take. Some deep thought which should be seriously considered by EU decision makers.

Summary

European leaders want to eliminate fossil fuels as a primary energy source and replace them in the short term with other sources of minimal carbon footprint. They should ask themselves what sense it makes to take a step that takes little account of mechanisms that are difficult to control. Changes of this kind take time. Rushing them can lead to a lock-in in favour of choices that are far from optimal. The analysis made in this work focuses on hostility towards nuclear energy, illustrating a situation that could arise in the future and that should be avoided.

Introduction

Countless technologies have accompanied human life since time immemorial. Technologies – in a broad sense, including systems and processes – have something in common with the living world in that they evolve on their own time scales. The comparison between their evolution and that of the living world is a subject that goes back to the time of Darwin. It was initiated by Samuel Butler, the English author of a short story entitled Erewhon [1]. What was at the time more the fruit of a fertile imagination than the result of structured scientific work eventually became the subject of very rigorous studies described in the book ‘The Nature of Technology – What it is and how it evolves’ by W. B. Arthur [2]. The main principles can be summarised as follows: all emerging technologies are partly based on existing technologies. Their emergence may be the result of the need to satisfy unmet needs in society, or it may be the result of the implementation of recent, untapped discoveries. As soon as a new technology appears, it can be coupled with existing technologies and participate in the process of extension of the tree. Trial-and-error adaptation processes are at work, which allow the components of a technology to be adapted to their most advanced state at any given time. The evolutionary process is autopoietic (a) in the sense that a technology fully participates in its own transformation [2]. Examples of recent technologies illustrating this principle abound and everyone will have one or another in mind, depending on their expertise or interests.

In a liberal economy, it is the market that selects the technologies that best meet society’s needs. But, as we shall see, other considerations may come into play. The process of entering the market, or even of gradually dominating it, takes time. Moreover, it is not necessarily the most successful type in the sector (in the sense that needs to be clarified piecemeal) that achieves market dominance. Unlike the Darwinian biological world in which (very) long-term dominance is exercised by the most robust individuals, the world of technology does not obey this rule. It is therefore possible for dominance to be exercised by a suboptimal technology. As soon as a technology exerts dominance over its competitors, it is referred to as lock-in (b), the term being invoked especially in suboptimal cases [2,3]. The classic example of technological lock-in is the QWERTY/AZERTY keyboard invented by the American Christopher Sholes and adopted in 1873 for the typewriters of the Remington firm [4]. Although inferior to other keyboards (such as the Dvorak), it has remained the reference tool in an environment which, in the end, has nothing in common with the one in which it was born.

The automotive sector offers an interesting example of technological competition [5,6]. At the end of the 19th century, horse-drawn transport gradually gave way to automotive transport carrying the energy it needed. Three technologies appeared at about the same time: the steam engine, the electric motor and the internal combustion engine. The first two had shortcomings that allowed the third to take over by the 1930s (c) and dominate the market. Around the 1970s, the oil crisis led to a return of electric vehicles, but without much follow-up, as the batteries at the time were lead-acid like those of Edison. Then around 2000, thanks to the discovery of Li-ion batteries, the first signs of a questioning of the benefits of internal combustion appeared, with environmental pressure (atmospheric pollution by sulphur, nitrogen oxides, fine particles and CO2 emissions) supporting the movement. Hostility has continued to grow to the point where we are now witnessing a gradual return to the electric car, which may be destined to dominate the European market for reasons that are external to the economy (d). These two cases of lock-in are far from being the only ones, as nuclear technology delivered another one shortly after its birth (see [7]). We will come back to this.

Technology transition and time to market penetration.

In the early 1970s, two General Electric researchers, John Fisher and Robert Pry, developed an elementary mathematical model describing the substitution of one technology for another in a market free of constraints [8]. The model is based on simple principles: technological advance is a competitive process that participates in the rules of the market. If the substitution process manages to evolve by a few percent, it will continue to the end. Denoting by f(t) the market share of the new process at time t, the growth rate of this share is proportional to the remaining percentage of the old process (1-f). By translating these constraints into differential terms, it can be shown that the evolution of the market share follows a logistic Verhulst law (see [9])

(1)

(1)

The constants αand t0 appearing in the law, depend on the case treated. Initially, the substitution process is exponential in nature. A saturation effect sets in over time, as the fraction (1-f) of technology to be replaced decreases. The relationship (1) is also called “S-curve” because of the shape shown in Figure 1a. It is verified that in logarithmic representation, the quantity f/(1-f) is represented by a straight line as shown in Figure 1b, with the parameter t0 corresponding to the moment when the market share reaches 50%.

Figure 1 a (left) and 1 b (right) Time evolution of f(t) and f(t)/(1-f(t))

In their seminal paper, Fisher and Pry deal with a series of substitutions ranging from everyday products (natural fibres to synthetic fibres, leather to plastics, soap to detergents, etc.) to major industrial processes such as steel production, but without addressing the key sector of energy. All the cases discussed fit remarkably well into the logistical relationship (1), as shown in Figure 2. It can be seen that it took the Martin process, a substitute for the Bessemer process, about 40 years (1860 – 1900) to grow from a 1% to a 50% market share in steel production.

Marchetti, Nakicenovic [10,11] and Peterka [12], researchers at the International Institute for Applied Systems Analysis (IIASA), a research centre located in Austria, apply this methodology to energy technology transitions shortly before the second oil shock (1979). As these transitions involve different types of resources (wood, coal, oil, natural gas, uranium, etc.), the formulation of the problem is more complicated. Three reports published in the late 1970s describe the generalisation of the method with a varied sample of results. Figure 3 illustrates the worldwide evolution of the use of conventional fuels, nuclear power and solar and fusion energy (SOL FUS on the graph).

The coupling effects between competing systems are notable: the growth phase of the logistic law for system k substituting itself for system (k-1) is interrupted by the arrival of system (k+1), substituting itself and gradually reducing its market share.

This figure shows that the transition process takes about a century for a new technology to gain a 50% market share. Note that the numerical data is stopped at 1970 (the closest round year to publication) with logistical adjustments extended to 2050.

In 2007, Luis de Sousa updated Marchetti’s graph using the data of the time (Figure 3b) [13]. He shows that the conclusions are different from the 1970s model, probably due to the oil shocks that disrupted the market. He observes that after the oil counter-shock of the 1980s, the market seems to have frozen, with each energy source maintaining its market share. The market did not recognise new energy technologies. Four years before the Fukushima accident in 2011, nuclear power grew faster than Marchetti had predicted. In 2007, before there was a production mandate from the European Commission’s Directive 2009/28, alternative energy sources did not appear. L de Sousa explains that at that time wind energy represented 0.2% of the energy market, a percentage that nuclear energy had surpassed in the 1950s (e). It must therefore be admitted that Marchetti’s models are limited.

Exogenous market interference

The IEA statistical data (f) for the period up to the present day also shows a slightly different picture of the evolution of f(t)/(1-f(t)) for energy technologies, illustrating the impact of decisions that counteract the evolution imposed by the market alone. Figure 5 highlights this for biomass and nuclear: the former seems to emerge from a phase of decline around 1960, driven by public opinion in favour of renewable energies, while after a fairly short rise, the latter undergoes a relative fade around 2000, linked to public concerns following the disasters at Chernobyl (1986) and Fukushima (2011).

Exogenous influences are perfectly detectable in the evolution of the parameter f(t)/(1-f(t)). If technological innovation and market mechanisms had been in sole charge, in the sense of Fisher and Pry, figure 5 would have looked more like figure 3.

Exogenous influences are particularly marked in the field of oil. Originally, oil was sought as a substitute for whale oil. When the internal combustion engine was introduced, as we saw at the beginning, its demand rapidly increased, creating a new market that strongly influenced demand and price. The operation of the oil market as a cartel set up by the Aschnacarry Agreement of 1928 between Standard Oil of New Jersey, Royal Dutch Shell and the Anglo-Persian Oil Company kept the price of crude oil under control despite the growing demand. The OPEC takeover of production was an exogenous factor that limited growth while increasing the price. More recent examples of exogenous geopolitical factors are the overheating crisis and the war crisis in Ukraine. All this has created an erratic evolution of the oil price. Figure 6 shows the difficulty of correlating demand and price (g).

Interference from the European Green Deal

The European Union (EU) is not in the business of imposing an energy choice on its Member States. Since its creation, it has been careful not to say what primary energy should be used, with Article 194.2 of the Lisbon Treaty stating de jure that, despite the shared competence of energy with the Member States, the latter have the freedom to choose to exploit their own resources and to use what suits them. Since 2020, this freedom has been increasingly restricted de facto. The European Commission, aware of the limits of its action on the energy mix, is subordinating energy policy to a climate policy, or even more generally to an environmental policy. This has led to the Green Deal, which imposes a technological choice reinforced by a generous post-Covid financing plan.

The European Commission’s carbon footprint elimination policy aims to concentrate EU efforts and resources in the relatively narrow sector of intermittent renewable energies (IRE) and biomass, to the exclusion of nuclear, which has a near-zero carbon footprint. This is evidenced by the long dithering that preceded the recent adoption of the European Commission’s delegated act on green taxonomy. It aimed to undermine the sovereign choice of certain Member States in favour of nuclear electricity. Pressure from 11 Member States overcame the EC leadership’s opposition to its inclusion, but the future of nuclear power in Europe is far from clear as the percentage of MEPs who opposed the taxonomy was 43% (h). The realism of the Green Deal policy is questionable and has been discussed in detail in reference [9].

In any case, sovereign and exogenous decisions are able to impose choices, as shown by the decisions of the European Parliament and the EU Council in June 2022 on the total ban on thermal vehicles by 2030. This leads to an important question: are the technologies put forward the most efficient in the long term? And, if so, by what criteria? There are other technologies under development that could offer superior environmental performance, but as they may take time to reach full maturity, this key fact must be taken into account.

This is the case of the nuclear future (Gen-IV) of which few European politicians seem to be aware.

The lock-in of current nuclear power (Gen-II)

At the end of December 1942, a team of physicists from the University of Chicago under the direction of Enrico Fermi carried out the first chain reaction using the phenomenon of fission, the physical properties of which were then well known. At that time, the world’s needs dictated the priorities. With the end of the Second World War and the start of the Cold War against the Soviet bloc, the priorities were military. Physicists were aware that the variety of chain reaction systems was considerable, depending on the choice of moderator (i) (a light element such as hydrogen, deuterium or carbon) and coolant (ordinary or heavy water, gas or liquid sodium). The graphite-moderated CP-1 reactor offered excellent neutron ‘economy’, but graphite leads to less compact power facilities than water-moderated ones. The neutron economy of light water reactors (k) (LWR) on the other hand is less favourable than that of graphite or heavy water moderated reactors (D2 O). The size imperative being essential, LWRs will be chosen for the propulsion of US Navy submarines [15,16]. As the industry (Westinghouse, General Electric) was involved in the programme, the power reactors that would follow (called Generation II and III – Gen-II/Gen-III), would naturally belong to the same technology requiring uranium enriched in 235U. The United Kingdom and France will initially opt for natural uranium (Unat) and graphite, while Canada will choose Unat and heavy water for its CANDU line (l). Over time, only the CANDU reactors among the lines authorising Unat will be maintained, the French-English reactors of the French graphite-gas line being supplanted by LWRs. This is what leads some researchers to consider the current nuclear technology as locked in [7].

Nuclear energy of the future (Gen-IV)

In 2001, the US Department of Energy (DOE) launched an initiative to identify nuclear technologies that meet stringent safety, economic, environmental and non-proliferation criteria for future primary energy production. A study group called Generation-IV International Forum (GIF) is created. Several countries responded to the call (m) and identified six technologies that met these requirements. One of the six – molten salt technology (n) – had been the subject of experiments in the 1950s at Oak Ridge Laboratory. This technology is considered by the Gen-IV Roadmap editors to be one of the most attractive and safe nuclear technologies for many reasons (see [17]):

- The absence of water in the reactor core eliminates the risk of a loss-of-coolant accident (LOCA), as was the case in the Three Mile Island accident in 1979. It also eliminates the risk of hydrogen explosion from zirconium/water reactions that can occur on exposed high-temperature fuel rods (an event that occurred at Fukushima).

- the absence of sodium eliminates the risk of highly exothermic chemical reactions.

- A pressure close to atmospheric pressure, the liquid state of the fuel and favourable neutron properties (strongly negative temperature reactivity coefficient) also contribute to safety.

- The fact that at operating temperatures (∼700 °C) the fuel for MSRs is in the liquid phase makes it easier to feed fresh fuel than for solid fuel systems. Although this is a delicate operation, a regular supply is possible, which is not the case for solid fuel systems. There is therefore no need for a long-term reactivity reserve, which eliminates the risk of a Chernobyl-type criticality accident. Moreover, MSRs are not equipped with control rods.

- The composition of the molten salt is such that the liquid state can be maintained up to 1,400 °C, well above operating values. If for any reason the temperature of the salt falls below 459 °C, the melting temperature of the lithium beryllium fluoride (LBF) of which it is composed, solidification occurs with mass retention of the non-volatile fission products.

Such characteristics have a positive impact on the economy, by reducing the need for active systems to guarantee the safety of the installations, such as those used in current LWR plants. Finally, the ultimate interest: molten salt installations with fast neutron spectra would open the way to a reduction in the nuclear ‘liabilities’ of current reactors (plutonium and minor actinides with very long half-lives) that are unmanageable in the latter. Inserting this spent fuel as a fuel source in these SRMs would simultaneously exploit its residual energy content and eliminate a highly problematic environmental presence of radioisotopes with several hundred thousand half-lives.

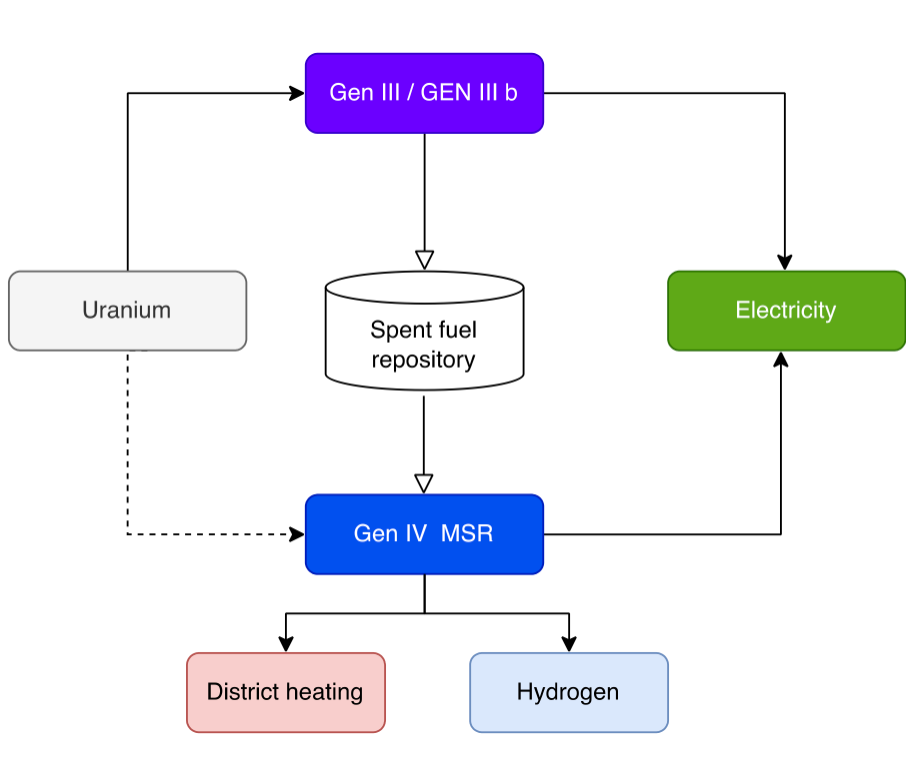

The conclusions of the Gen-IV Roadmap will give rise to an enormous revival of interest throughout the world (North America, Europe, Russia, China, Japan) in a technology that went into a state of lethargy in the early 1980s. This is evidenced by the numerous R&D projects that should lead to concrete achievements over the next 15 to 20 years (see [15, 16, 18]). Particular attention should be paid to the projects of the organisations Moltex, Elysium and TerraPower. These are three fast reactor projects specifically designed to produce high-temperature primary energy (electricity and process heat) by exploiting not only conventional mineral resources (235U and 239Pu produced from the Pu produced from the conversion of 238 U), but also the existing stock of spent fuel from current LWR and CANDU reactors with the range of fissile cores contained. And, in the process, transform an environmentally unsustainable easement for the most ardent opponents of nuclear power into an energy resource that can be used until all contained fissile nuclei are exhausted (Figure 7).

This industrial heat production is of the utmost importance (o). In energy policy, the use of heat is too often neglected. 2022 crisis in Germany has finally highlighted this fundamental need for “final energy”, which the chemical industry badly needs. 94% of the natural gas used in Germany is used for thermal purposes.

This heat produced by the new nuclear reactors will also be the energy source for the thermal decomposition of water into hydrogen when consumer applications become available (Figure 8). The EU policy requirement in the Green Deal for rapid hydrogen production from variable and intermittent renewables may lock in this new area of hydrogen production in the pipeline.

Is Europe on the way to a deleterious lock-in?

The EU was born on the basis of the ECSC (1951) and Euratom (1958) treaties, which aimed to create an internal market for coal and steel and to promote civil nuclear energy respectively. Until recently, the European Commission was the guardian and promoter of the latter. Under the influence of a very hostile Germany, the Commission has gradually withdrawn from the latter.

By choosing to promote renewable energies “whatever it takes” and by not taking a firm position in favour of nuclear energy as required by the Euratom Treaty, the European Commission is weakening the European development of this technology at the expense of variable and intermittent renewable energies. It risks locking in the future in favour of the latter while several environmental indicators are in favour of nuclear. This is the case, for example, for footprints, material requirements (concrete, metals, cement, glass and others) and system costs. Unlike variable and intermittent renewables, nuclear reactors do not create geopolitical dependence on China, which dominates the market for rare earths and other metals that renewables need, as we will see below. We would see a real lock-in not only of the technology, but also of our geopolitical dependence.

Table 1 compares the power footprints (expressed in m2/GW) of nuclear plants and intermittent renewable energy sources on the basis of data collected in a very large geographical area ([19]). Intermittent renewable energy sources have very low power densities compared to classical sources. This implies much larger footprints than nuclear plants. The ratio depends on both location and technology and goes approximately from 200 to 1000.

Figure 9 shows the basic material requirements (excluding fuel resources) for the implementation of energy technologies, including nuclear and renewable energy. These requirements are expressed in thousands of tonnes per TWh. Here again, nuclear power has advantages over variable and intermittent renewables. Despite the considerable quantities of concrete that are invested to guarantee the safety of the installations, these quantities are lower than those required by wind power; and much lower still than those invested in the construction of dams. What also deserves attention are the quantities of metals, cement and glass required by solar photovoltaics. In absolute terms, solar PV requires the most material resources.

Last but not least, the cost of these technologies has been extensively studied by the OECD’s NEA agency. In a report entitled ‘The Full Costs of Electricity Provision’, the agency inventories the different components of the cost of production [21]. This is particularly important for intermittent generation (wind, solar PV) which faces supply difficulties in the event of a prolonged intermittency. To guarantee the supply of demand, variable and intermittent renewable energies must be replaced by controllable means which themselves represent a cost and whose profitability is not necessarily optimal. All these elements guaranteeing security of supply are to be classified (from a cost point of view) in what the NEA calls the ‘system cost’. More than the costs of production, operation and maintenance, it is the system costs that make the difference between these different technologies (controllable and intermittent). This is illustrated in Figure 10 from the report [21]. The system cost (in US$/MWh) is shown for controllable (fossil, nuclear) and intermittent (wind, solar PV) technologies for two penetration rates of the latter in the electricity system. It should be noted that the system cost is made up of different elements, namely connection, transmission and distribution, grid balancing and usage costs.

It is not surprising to conclude that controllable production is the most economically interesting.

All three elements of comparison (footprint, materials and costs) point in the same direction: nuclear technology is preferable to variable and intermittent renewables. Of course, in the studies referred to, Gen-II technology was used to assess the various parameters. The forthcoming arrival of Gen-IV should not fundamentally change the conclusions. And, as mentioned earlier, the inherent safety of future nuclear power should make the technology more attractive. The biggest hurdle to overcome will be the psychological one, as an instinctive fear of radiation permeates the public mind.

Conclusion

Evolution and ‘transition’ of technologies are processes that take time. There are many reasons for this: technical, commercial or other. The great successes of the past make us forget today that at the time they took place, things were far from simple and that there was very often resistance to change for many reasons, including commercial ones. This was particularly the case in Drake’s time (1859), at the beginning of the industrial era of rock oil (p), a competitor to coal oil, turpentine and whale oil, especially for lighting (see [5]). The use of this commodity eventually took off in the transport sector.

In the case of Gen-IV nuclear power discussed in this work, the time needed for future deployment of this technology is related to its fine-tuning. Its advantages over Gen-II and Gen-III technologies are known, and previous successful implementation only reinforces the attractiveness of this new technology. The biggest hurdle to overcome will be the psychological one, as an instinctive fear of radiation permeates the public mind in the West.

This fear is far from universal: what will the EU do if it is confirmed that in 20 years’ time the rest of the world, having not taken part in the ‘monoculture’ of variable and intermittent renewables, will have taken a serious lead in these new technologies, which are free of the main shortcomings of current installations – accident risks, long-lived waste – and have eminent environmental qualities? To ignore this possibility is to set up a pernicious lock-in that future generations may regret. Very paradoxically, for essentially environmental reasons…

(a)Greek word borrowed from biologists, describing the property of systems to transform themselves.

(b) Anglo-Saxon authors who have studied the subject speak of a ‘technological lock-in’.

(c) The placement of the letters on the keyboard took into account the statistics of the succession of letters to avoid the arms carrying the fonts colliding when writing. Today this is totally outdated, but the keyboard designed for mechanical use has remained for digital use

(d) Thomas Edison and Henry Ford were friends and sat on each other’s boards. Since 1899 Edison had been racing to develop the electric car and Ford to develop the combustion car. Edison eventually acknowledged that his friend had won with his success with the Ford T in 1908.

(e) The EU decided in June 2022 to ban the sale of new internal combustion vehicles by 2035.

(f) In 2018, wind and solar accounted for only 2.5% of primary energy consumption in the EU-27 as noted in the note [14].

(g) International Energy Agency

(h) For a full treatment of this topic see Samuel Furfari ‘Oil, between monopolies and free market‘, in ‘Beyond Market Assumptions: Oil Price as a Global Institution’ edited by Andrei V. Belyi, Springer, 2020

(i) 278 against, 33 abstentions and 328 in favour.

(j) A substance which, by elastic collision with neutrons, reduces their kinetic energy and increases their probability of causing fission when captured in a 235U nucleus.

(k) Normal water H2 O as opposed to heavy water with deuterium (D2 0).

(l) Acronym for CANada Deuterium Uranium

(m) Argentina, Brazil, Canada, France, Japan, South Korea, South Africa, the United Kingdom and the United States, later joined by Switzerland, the EU, China, Russia and Australia

(n)Molten Salt Reactors – MSR

(o) We have dealt with this issue in Samuel Furfari and Ernest Mund, “Renewable energy in the EU: from perception to reality”, [14].

(p) Etymology of the word ‘Petrol’

References

- S. Butler, ‘Erewhon’, 1872, 272 pp, Penguin Classics, 2000.

- W.B. Arthur, ‘The Nature of Technology – What it is and how it evolves’, Penguin, 2009.

- W. B. Arthur, ‘Competing Technologies, increasing returns, and lock-in by historical events’, The Economic Journal, volume 99, 116-131, 1989,

- P. A. David, ‘Clio and the economics of QWERTY’, American Economic Review, 75, 332-337, 1985,

- R. Rhodes, ‘Energy – A human history’, Simon Schuster, 2018,

- R. Cowan, S. Hulten, ‘Escaping lock-in: The case of the electric vehicle’, Technological Forecasting and Social Change, volume 53, 61-79, 1996,

- R. Cowan, ‘Nuclear Power Reactors: A Study in Technological Lock-in’, The Journal of Economic History, volume 50, 541-567, 1990,

- J. C. Fisher, R.H. Pry, ‘A Simple Substitution Model of Technological Change’, Technological Forecasting and Social Change, volume 3, 75-88, 1971,

- S. Furfari, E. Mund, ‘Is the European green deal achievable? ’, European Physical Journal Plus, 136:1101, 2021,

- C. Marchetti, N. Nakicenovic, ‘The Dynamics of Energy Systems and the Logistic Substitution Model‘, IIASA, RR-79-13, Laxenburg (Austria), 1979,

http://pure.iiasa.ac.at/id/eprint/1024/1/RR-79-013.pdf

- N. Nakicenovic, ‘Software Package for the Logistic Substitution Model’, IIASA, RR-79-12, Laxenburg (Austria), 1979,

- V. Peterka, ‘Macrodynamics of Technological Change: Market Penetration by New Technologies’, IIASA, RR-77-22, Laxenburg (Austria), 1977.

- L. de Sousa, ‘Marchetti’s Curves’, The oil Drum: Europe, 10-07-2007, http://theoildrum.com/node/2746,

- S. Furfari, E. Mund, ‘Renewable energy in the EU: from perception to reality‘, Energy Literacy, 27-11-2020, https://www.connaissancedesenergies.org/tribune-actualite-energies/energies-renouvelables-dans-lue-de-la-perception-aux-realites,

- S. Furfari, E. Mund, ‘Transport maritime et course aux SMR avancés‘, La Revue de l’Energie, n° 661, 27-35, 2022,

- S. Furfari, E. Mund, ‘Advanced nuclear power for clean maritime propulsion’, to appear in The European Physical Journal Plus, 2022.

- U.S. DOE NERAC, ‘A Technology Roadmap for Generation IV Nuclear Energy Systems’, 2002 www.gen-4.org/PDFs/GenIVRoadmap.pdf,

- IAEA, ‘Advances in Small Modular Reactor Technology Developments’, Supplement to ARIS, 2020, http://aris.iaea.org

- Michel Deshaies, ‘Geographical problems of energy transitions: what perspectives for the evolution of the energy system?’ Developing Worlds, 2020/4 (No. 192), pages 25-44

- https://world-nuclear.org/information-library/energy-and-the-environment/nuclear-energy-and-sustainable-development.aspx

- OECD-NEA, ‘The Full Costs of Electricity Provision’, 2018

Read more

“The Greens are having a Coyote moment” Steven E. Koonin (Interview)

Image par PublicDomainPictures de Pixabay

This post is also available in: DE (DE)

Excellent and to the point!

One should also consider that, as long as the World energy supply continues depending on 90 % on the use of fossil fuels (and this decreases by a meagre 0.4 to 0.4 % per year), forcing a switch to electric cars and heat pumps may increase the demand for electricity, while it will take a very long time for the installed capacity to be replaced by non-fossil energy sources.

So, the cart is put before the potentially wrong horse.